It’s a question the Plato team is asked frequently – what are franking credits?

Franking credits are a tax credit paid alongside dividends for company tax that has already been paid by an Australian company. So, consider a company like BHP (ASX: BHP) – if they make $100 million pre-tax profit they’ll pay 30% tax (which is $30 million). Thus, there will be $70 million of after-tax profits left over. If they then decide to pay out all of that $70 million to shareholders as a fully franked dividend, there will be a $30 million franking credit. This franking credit helps prevent double-taxation, as BHP has already paid tax on its profit and then the investor who receives the dividend may also have to pay tax on the dividend income.

From the investor’s point of view, they can use that credit to pay tax they would otherwise pay. Depending on an individual’s tax rate, they might actually get a tax refund. For example, a pension phase superannuation investor with a balance of less than $1.7 million are not taxed at all.

In the example above, the profits of BHP had been taxed at 30%, but as a zero-tax investor (such as a retiree) the tax rate is zero so they actually get a full 30 cents in the dollar refund – a refund of all that tax credit.

You can see why a lot of retirees were up in arms when the Australian Labor Party tried to take away that refund in 2019. It would have make a huge impact on their after-tax income.

So, for retirees, it’s important to understand what franking credits are because they are a very important part of income investing.

Franking credits highlight the importance of tax-effective portfolio management

Having consideration for clients’ taxation circumstances is critical for income fund managers – however we find very few actually do this.

We don’t eat before-tax returns, we consume after tax-returns.

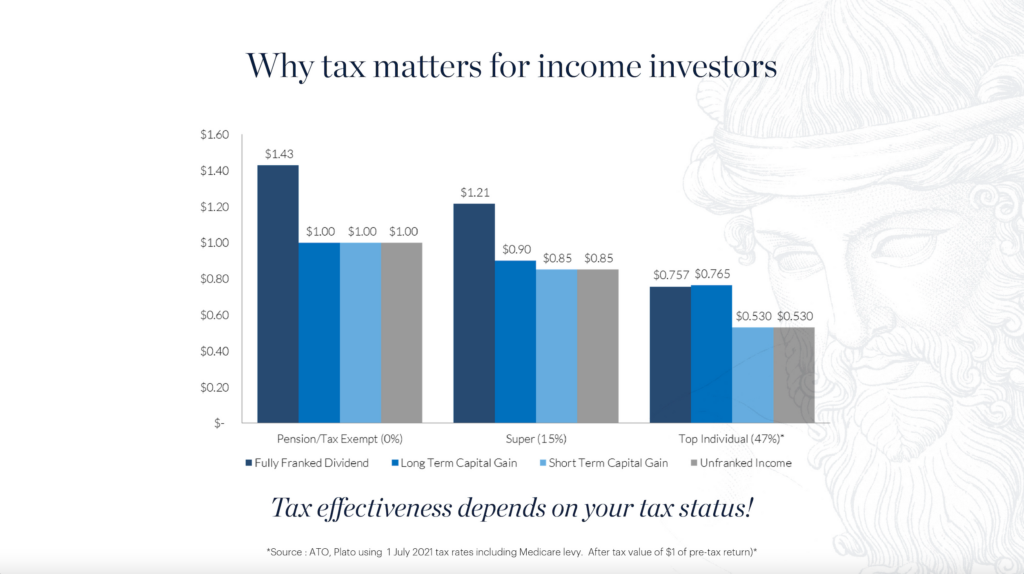

In the chart below we illustrate the after-tax value of $1 of pre-tax income for three different taxation levels.

First (on the left) you can see the value of $1 of pre-tax income for zero-tax investors (this would also be the first $1.7 million in pension phase superannuation). Then you can see the same for a 15% tax rate investor (which is the tax rate for accumulation based super), and on the right, we’ve looked at it from the highest marginal personal tax rate.

You can see the after-tax value of income is different for these three different types of investors, and it’s one reason why the strategy of the Plato Australian Shares Income Fund is targeted specifically for retirees and pension phase super because they are taxed differently to other types of investors.

You can clearly see a $1 fully franked dividend is actually worth $1.43 because you get a forty-three cent tax credit when you put your tax return in at the end of the year. So for those investors getting more franking credits is a great way to increase income.

At 15% super the pattern is somewhat similar. The fully franked dividend is still worth the most, but because the tax rate is 15%, its is only worth $1.21 after tax – still substantially more than other forms of income such as rental income, or interest income which has no franking credits, and short term capital gains which are both taxed at 15% and its substantially better even than a long term capital gain because in superannuation you are taxed at 10%. So if you’ve got a $1 long term capital gain its actually only worth 90 cents in $1.

If you flip it around and go to the highest tax investors, who are paying 45 cents in the dollar plus two cents Medicare, the actual best way for them to maximise after tax income is through long term capital gains.

That’s why many investors argue you should have low turnover strategies because you want to get a lot of capital gains, and long term capital gains. But retirees and other zero-tax investor would lose out from an investment strategy focussed on this.

Retirees are different, their money needs to be managed differently too

Pension phase investors don’t pay tax at all so capital gains tax is irrelevant for them. And that’s why I believe all retirees should ensure their money is being managed with their taxation circumstances front-of-mind.

That’s why here at Plato we’ve established strategies for the zero tax end of the market – investors that are most reliant on the income for their investments to make ends meet.

My colleague, Dr Peter Gardner writes more about the benefits of managing portfolios on an after-tax basis in this article.

SUBSCRIBE TO OUR NEWSLETTER FOR MORE INCOME INVESTING INSIGHTS

SUBSCRIBEDISCLAIMER:

This document is prepared by Plato Investment Management Limited ABN 77 120 730 136, AFSL 504616 (‘Plato’). Pinnacle Funds Services Limited ABN 29 082 494 362, AFSL 238371 (‘PFSL’) is the product issuer of the Plato Australian Shares Income Fund (‘the Fund’). The Product Disclosure Statement (‘PDS’) of the Fund is available at https://plato.com.au/. Any potential investor should consider the relevant PDS before deciding whether to acquire, or continue to hold units in, a fund.

Plato and PFSL believe the information contained in this document is reliable, however no warranty is given as to its accuracy and persons relying on this information do so at their own risk. This communication is for general information only and was prepared for multiple distribution and does not take account of the specific investment objectives of individual recipients and it may not be appropriate in all circumstances. Persons relying on this information should do so in light of their specific investment objectives and financial situations. Any person considering action on the basis of this communication must seek individual advice relevant to their particular circumstances and investment objectives. Subject to any liability which cannot be excluded under the relevant laws, Plato and PFSL disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information.

Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. Past performance is not a reliable indicator of future performance.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this document is prohibited without obtaining prior written permission from Plato. Plato and their associates may have interests in financial products mentioned in the presentation.