Participating in off-market Australian share buybacks, is one way Plato generates additional after-tax income for retirees and other low-tax investors.

Off-market share buybacks are a way for companies to divert the franking credits on their balance sheets to the investors that value them most – zero-tax investors.

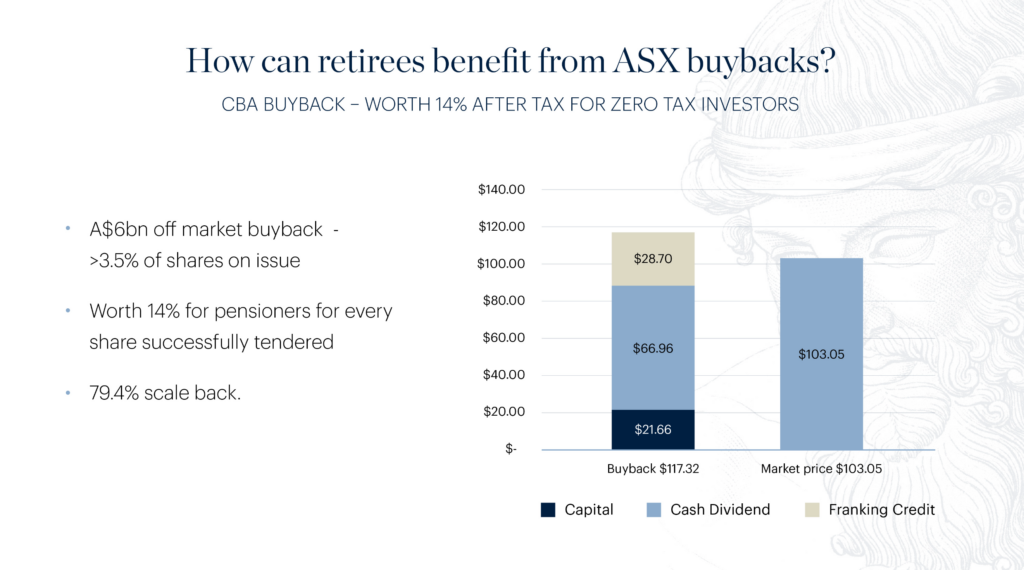

To provide an illustration of how low-tax investors can benefit from off-market share buybacks, let’s look at the Commonwealth Bank (ASX: CBA) off-market buyback that was completed in August 2021.

Commonwealth Bank was trading at $103 per share at the time and they were able to purchase back their shares in the off-market buyback at $88.62.

You might ask, why would anyone allow their shares to be bought back at $88.62 when it is trading at $103?

The reason is because of the way the buyback is structured. It has a capital component and then it has a fully franked divided component on top, and that fully franked dividend carries franking credits. So, in Commonwealth Bank’s case it had a $21 capital component and then the remainder was a fully franked dividend which had then franking credits on top.

When you added that all together you actually found that the value for a zero-tax investor was just over $117 (because they get to reclaim those franking credits back from the government). This was 14% more than the current share price of Commonwealth Bank at the time.

So you can see why off-market share buybacks was very profitable for zero tax investors.

So you can see why off-market share buybacks was very profitable for zero tax investors.

For tax paying investors, particularly high marginal tax rate investors, these buybacks aren’t actually profitable because they pay income tax on the full value of the fully franked dividend and the franking credits attached.

The Plato Australian Shares Income Fund, is designed specifically for zero-tax investors, so we actually make all our decisions on the basis of how a zero tax investor benefits, thus we regularly participate in these buybacks.

Since inception of the Fund in 2011, we have gained about 40 basis points per annum just by participating in buybacks and added that to the total return of our investors.

We think it is a great way for investors to get the icing on the cake in terms of their income.

SUBSCRIBE TO OUR NEWSLETTER FOR MORE INCOME INVESTING INSIGHTS

SUBSCRIBEDISCLAIMER:

This document is prepared by Plato Investment Management Limited ABN 77 120 730 136, AFSL 504616 (‘Plato’). Pinnacle Funds Services Limited ABN 29 082 494 362, AFSL 238371 (‘PFSL’) is the product issuer of the Plato Australian Shares Income Fund (‘the Fund’). The Product Disclosure Statement (‘PDS’) of the Fund is available at https://plato.com.au/. Any potential investor should consider the relevant PDS before deciding whether to acquire, or continue to hold units in, a fund.

Plato and PFSL believe the information contained in this document is reliable, however no warranty is given as to its accuracy and persons relying on this information do so at their own risk. This communication is for general information only and was prepared for multiple distribution and does not take account of the specific investment objectives of individual recipients and it may not be appropriate in all circumstances. Persons relying on this information should do so in light of their specific investment objectives and financial situations. Any person considering action on the basis of this communication must seek individual advice relevant to their particular circumstances and investment objectives. Subject to any liability which cannot be excluded under the relevant laws, Plato and PFSL disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information.

Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. Past performance is not a reliable indicator of future performance.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this document is prohibited without obtaining prior written permission from Plato. Plato and their associates may have interests in financial products mentioned in the presentation.