The hidden cost of indexing – the ultimate crowded trade?

13 DECEMBER 2023

Shrewd investors are always looking for new trends, however one of the strongest trends in markets over the last 50 years has been driven by the argument that picking trends is for the birds!

We are referring, of course to the humble index fund.

Conceived by John Bogle in the mid 70’s, the index fund started as a widely derided concept but has since seen an inexorable rise in popularity. Passive investments have become a style in their own right, with index funds and their ETF variants being applied to almost every widely followed index worldwide. The birthplace of index investing has arguably seen the most explosive growth … as of the end of 2020, 54% of total U.S. equity fund assets were in passive funds, up from around 14% in 2005.

The key argument for passive investing is its low cost. This may seem at first difficult to argue against. The second plank in the argument is that markets are too hard to beat, and every good idea quickly becomes a crowded trade. However, the sheer scale at which index funds are now invested begs the question … is the very logic used to argue for passive starting to work against it? Is passive investing becoming a crowded trade?

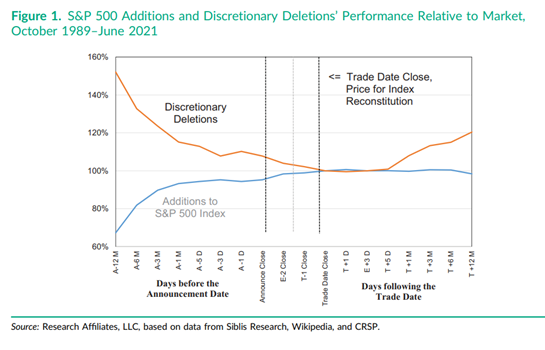

In April, an interesting paper titled “Earning Alpha by Avoiding the Index Trade” was published in the Financial Analysts Journal. They find that reproducing the S&P 500 index, with simple tweaks to avoid the stampede of trades around index changes can produce a return that is consistently higher than the index itself.

Their approach was simple: what if you wait 3 months after the official index inclusions and exclusions announcements occur, before making the changes yourself? What if you wait 12 months? The study was on the S&P 500 Index between 1989 and 2001. These two “lazy indices” proved to be effective … both produced returns between 13 and 23 bps above the quoted index return.

| S&P 500 | Return | Volatility | Excess Return vs Replicated S&P 500 | Tracking Error vs Replicated S&P 500 | Information Ratio vs Replicated S&P 500 | Statistic on Excess Return |

| Replicated S&P 500 | 10.48% | 14.42% | ||||

| Replicated Trade-on-Announcement S&P 500 | 10.68% | 14.36% | 0.20% | 0.31% | 0.64 | 3.63 |

| Replicated Day-after-Announcement S&P 500 | 10.61% | 14.37% | 0.12% | 0.29% | 0.42 | 2.37 |

| Lazy Replicated S&P 500, Trades Delayed by 3 Months | 10.61% | 14.34% | 0.13% | 0.33% | 0.39 | 2.17 |

| Lazy Replicated S&P 500, Trades Delayed by 12 Months | 10.71% | 14.29% | 0.23% | 0.51% | 0.46 | 2.57 |

The returns are comparable to a more proactive strategy of trading on announcement, ie attempting to get set index changes before their “effective date”, which is typically a few weeks prior.

The return improvement of trading before or after the index change highlight the hidden cost of indexing. As the ever-growing index funds are obliged to trade changes as close as possible to the effective date, they create a supply demand imbalance, thus buying high and selling low!

You can see this clearly when you look at performance of stocks around the date of inclusion in the S&P 500 index. Exclusions, on average are at their lowest price point when excluded, and inclusions, which are typically new market darlings, seem to run out of steam once they are included.

We undertook the same analysis on the Australian market and found very similar results.

Our analysis included both ASX 200 and ASX 300 indices and was conducted between April 2000 and September 2023.

| S&P/ASX 300 | Return | Volatility | Excess Return vs Replicated S&P/ASX 300 | Tracking Error vs Replicated S&P/ASX 300 | Information Ratio vs Replicated S&P/ASX 300 | Statistic on Excess Return |

| Replicated S&P/ASX 300 | 7.61% | 15.40% | ||||

| Lazy Replicated S&P/ASX300, Trades Delayed by 3 mths | 7.71% | 15.40% | 0.11% | 0.30% | 0.36 | 1.75 |

| Lazy Replicated S&P/ASX300, Trades Delayed by 6 mths | 7.77% | 15.41% | 0.16% | 0.41% | 0.39 | 1.90 |

| Lazy Replicated S&P/ASX300, Trades Delayed by 12 mths | 7.86% | 15.42% | 0.25% | 0.62% | 0.40 | 1.96 |

| S&P/ASX 200 | Return | Volatility | Excess Return vs Replicated S&P/ASX 200 | Tracking Error vs Replicated S&P/ASX 200 | Information Ratio vs Replicated S&P/ASX 200 | Statistic on Excess Return |

| Replicated S&P/ASX 200 | 7.65% | 15.49% | ||||

| Lazy Replicated S&P/ASX200, Trades Delayed by 3 mths | 7.76% | 15.48% | 0.11% | 0.30% | 0.35 | 1.69 |

| Lazy Replicated S&P/ASX200, Trades Delayed by 6 mths | 7.82% | 15.48% | 0.17% | 0.43% | 0.39 | 1.90 |

| Lazy Replicated S&P/ASX200, Trades Delayed by 12 mths | 7.89% | 15.48% | 0.24% | 0.63% | 0.38 | 1.84 |

The similarity in results is striking! Taking a relaxed approach to implementing changes to index constituents will lead to stronger returns, in the vicinity of 11bps to 24bps per annum! Who says markets are efficient … the market is rewarding laziness!

Some fund managers see the rise of passive funds as an existential threat to active management. At Plato, we take a different view. Passive funds that slavishly follow pre-defined rules are effectively telegraphing their every move to the market. Astute managers can look to profit from this rigidity by taking short (or underweight) positions in companies that are likely to depart a large passive ETF and long positions in companies likely to be added (or which have recently been removed and traded down).

The rise of thematic ETFs can also be exploited by active managers. As these ETFs are almost always launched when market fervour is peaking, and it is almost always better to bet against the trend.

Discover Plato’s range of investment opportunities: https://plato.com.au/strategies/

DISCLAIMER:

This document is prepared by Plato Investment Management Limited ABN 77 120 730 136, AFSL 504616 (‘Plato’). Pinnacle Funds Services Limited ABN 29 082 494 362, AFSL 238371 (‘PFSL’) is the product issuer of Plato Funds. Product Disclosure Statement (‘PDS’) are available at https://plato.com.au/. Any potential investor should consider the relevant PDS before deciding whether to acquire, or continue to hold units in, a fund. The Product Disclosure Statements (‘PDS’) and Target Market Determinations (‘TMD’) of Plato Fund is available at https://plato.com.au/. Pinnacle Fund Services Limited is not licensed to provide financial product advice.

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so.

Past performance is for illustrative purposes only and is not indicative of future performance. Stock commentary is illustrative only and not a recommendation to buy, hold or sell any security.

Whilst Plato, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Plato, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Plato. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

SUBSCRIBE TO OUR NEWSLETTER

Subscribe to keep up to date with the latest fund

information and insights.

“A good decision is based on knowledge and not on numbers.”

Plato (427-347 BC)