In a matter of months, we’ve experienced a remarkable turn-around when it comes to Australian equity income and right now it’s safe to say dividends are back.

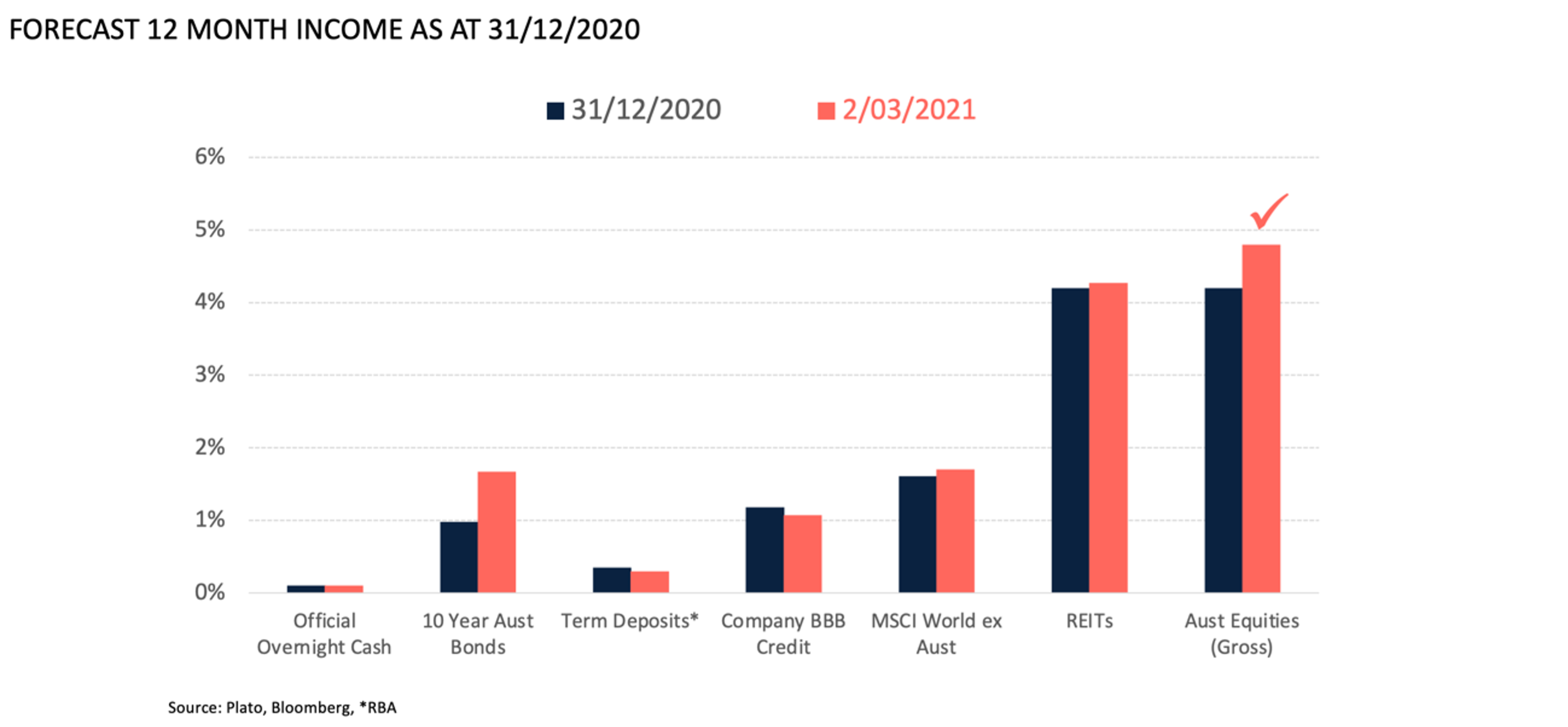

After a thorough analysis of the February reporting season, the Plato team has updated its Australian equity income outlook. We now forecast the ASX200 will return a 4.8% gross yield in the coming 12 months and think high-quality active management should be able to deliver an additional 2-3% on top of the index.

The Plato Australian Shares Income Fund is targeting gross yield of around 7.8% in the coming 12 months – an additional 3% to the market delivered through our tried-and-tested active investment process.

For self-funded retirees who ain’t got a lot to spare, this is great news.

At every RBA cash rate cut over the past decade, self-funded retirees have been dealt a blow and earlier this year they would have heard the RBA Governor state any increase to the cash rate is unlikely until at least 2024.

Generating meaningful returns from cash in the bank or bond yields has been near impossible for a number of years now and when dividends were slashed at height of the COVID-19 crisis, many would have been wondering how they were going to make ends meet. Thankfully, the dividend recovery has been swift.

The dividend income ascent

The last article I penned for the Plato Academy in the days ahead of February reporting season, was titled Cash rate locked, dividends unshackled. I highlighted a number of reasons why we believed dividends had been ‘unshackled’, including APRA repealing restrictions imposed on bank dividends and Federal Labor confirming it would no longer pursue changes to franking credits for retirees. This ‘unshackling’ certainly eventuated and has now evolved into what can best be described as a dividend income ascent.

Below, we have illustrated the change in our ASX200 index income forecast over just 2 months – from 31 December 2020, to 2 March 2021.

Other sectors to watch for dividend income

Mining stocks are the other big contributor to the dividend ascent. 39% of the increase illustrated above (20bps in yield) comes from mining stocks.

Plato has been banging the drum on miners for a number of years now and mining dividends just keep on delivering. For income investors this is a space, you simply can’t afford to ignore.

Of the top six dividend payers in Australia right now, three are mining stocks – Fortescue Metals, BHP Group and Rio Tinto. For dividend investors these are the ‘new banks’ and you can see here just how much cash they’re delivering to investors.

Over the past 3 years, while many income-focussed investors have ignored these three mining stocks, they’ve delivered our investors 3.4% p.a. gross income and we believe the income will keep coming in the foreseeable future. The supply and demand fundamentals for iron ore prices remain in-tact and even if prices do come off $50-100 dollars per tonne, these companies still remain quite profitable. Furthermore, management at the big miners seem to have learned from past mistakes about over-investing in new mines.

Much like the banks, there is also significant strength outside the big players. Mineral Resources is a great example of a smaller miner, offering exceptional income. Last month it announced a $1.00 dividend (3.9% gross yield) on net profit up 111%.

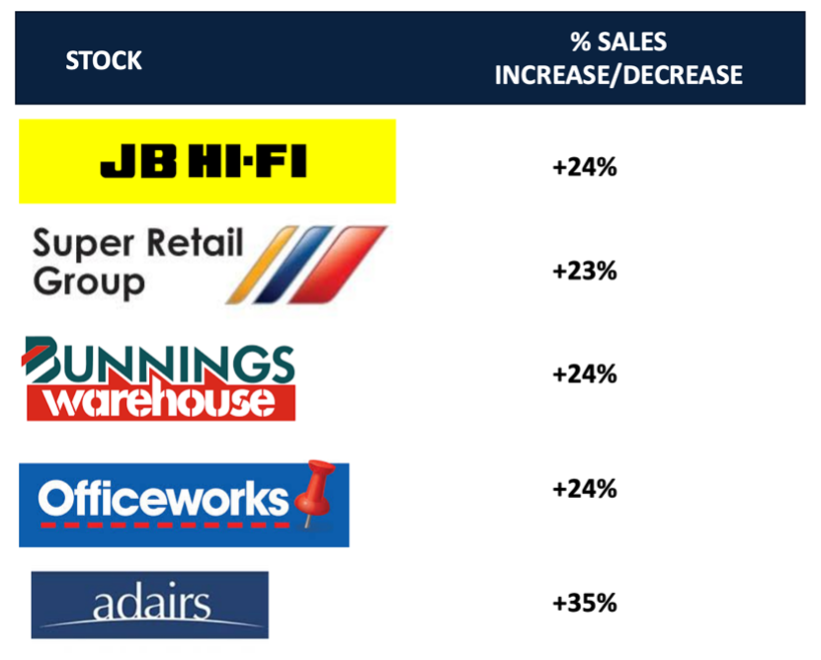

The remanding major contributor to the dividend ascent of the ASX200 index is Consumer Discretionary stocks. In this space, many leading retailers have been thriving and we think investors will continue to reap the dividend rewards throughout the remainder of the year.

JB Hi-Fi is one of our holdings that has delivered a stellar half-year result for income investors. Its record $1.80 dividend equates to a gross yield of 5.1%. Its half-year NPAT was up 86%. What is significant for the outlook is January 2021 like-for-like sales were up 17%. This is something also seen across other leading ASX-listed retailers and we believe this demonstrates the COVID-19-fuelled retail sales momentum has further to run.

Making the most of the dividend ascent

While this analysis is broadly based on the ASX200, as mentioned we believe active portfolio management is key to maximising income for retirees. A large number of dividend traps are hidden within the ASX200 – avoiding these is just as important as identifying the dividend stars.

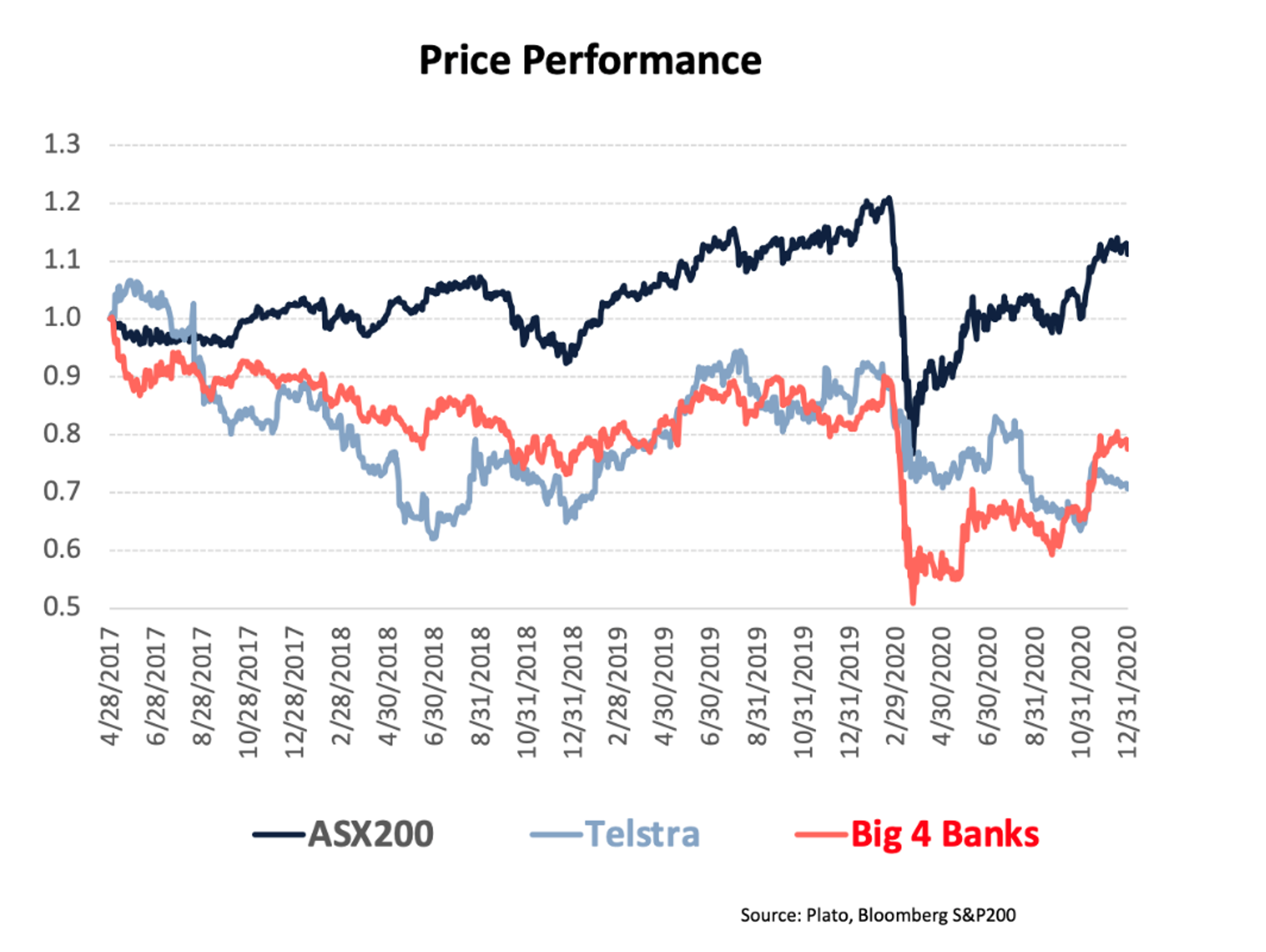

Over the past few years, we’ve also witnessed why a set-and-forget strategy is a sub-optimal income solution for self-funded retirees. Many Australian income investors have historically just sat on the Big 4 banks and Telstra, but if you look at our chart below, you can see how this set-and-forget strategy would have resulted in significant capital underperformance along with a reduction in dividend income over the past 5 years.

FY19 was the last time the Plato team labelled a period a ‘dividend bonanza’. Dividends are certainly not back to that level yet but they’re getting bigger. Or if Martin Plaza was a fund manager, he might say, “whoa-yeah, the divs are getting bigger!”

We think the best way to ride the ascent is a highly diverse portfolio of dividend paying equities, actively managed to optimise after-tax returns.

SUBSCRIBE TO OUR NEWSLETTER FOR MORE INCOME INVESTING INSIGHTS

SUBSCRIBEDISCLAIMER:

This document is prepared by Plato Investment Management Limited ABN 77 120 730 136, AFSL 504616 (‘Plato’). Pinnacle Funds Services Limited ABN 29 082 494 362, AFSL 238371 (‘PFSL’) is the product issuer of the Plato Australian Shares Income Fund (‘the Fund’). The Product Disclosure Statement (‘PDS’) of the Fund is available at https://plato.com.au/. Any potential investor should consider the relevant PDS before deciding whether to acquire, or continue to hold units in, a fund.

Plato Investment Management Limited (ABN 77 120 730 136, AFSL 504616) (‘Plato’) is the investment manager of Plato Income Maximiser Limited ACN 616 746 215 (‘PL8’ or the ‘Company’). PL8 is the issuer of the shares in the Company under the Offer Document. Any offer or sale of securities are made pursuant to definitive documentation, which describes the terms of the offer (‘Offer Document’) available at https://plato.com.au/lic-overview/ This communication is not, and does not constitute, an offer to sell or the solicitation, invitation or recommendation to purchase any securities and neither this communication nor anything contained in it forms the basis of any contract or commitment. Prospective investors should consider the Offer Document in deciding whether to acquire securities under the offer. Prospective investors who want to acquire under the offer will need to complete an application form that is in or accompanies the Offer Document. The Offer Document is an important document that should be read in its entirety before deciding whether to participate in the offer. Prospective investors should rely only on information in the Offer Document and any supplementary or replacement document. Prospective investors should contact their professional advisers with any queries after reading the Offer Document.

Plato and PFSL believe the information contained in this document is reliable, however no warranty is given as to its accuracy and persons relying on this information do so at their own risk. This communication is for general information only and was prepared for multiple distribution and does not take account of the specific investment objectives of individual recipients and it may not be appropriate in all circumstances. Persons relying on this information should do so in light of their specific investment objectives and financial situations. Any person considering action on the basis of this communication must seek individual advice relevant to their particular circumstances and investment objectives. Subject to any liability which cannot be excluded under the relevant laws, Plato and PFSL disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information.

Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. Past performance is not a reliable indicator of future performance.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this document is prohibited without obtaining prior written permission from Plato. Plato and their associates may have interests in financial products mentioned in the presentation.