Dr. David Allen

The idea that a fund manager must hold a concentrated portfolio to significantly outperform the benchmark is an enduring investing legend.

However, when you look at the data, this widely held conclusion seems somewhat questionable. Afterall, Renaissance Technology, the most successful hedge fund of all time has generated returns in excess of 70% p.a. before fees and has several thousand positions at any one time.

So, let’s dig in a little deeper.

Have concentrated managers generated superior performance to diversified managers on average over time?

The star manager effect

For decades, the idea of the “star fund manager”, with a perceived extraordinary ability to identify the super compounders hiding in plain sight, has reigned supreme.

Typically, the portfolios of star managers have been concentrated with less than fifty holdings.

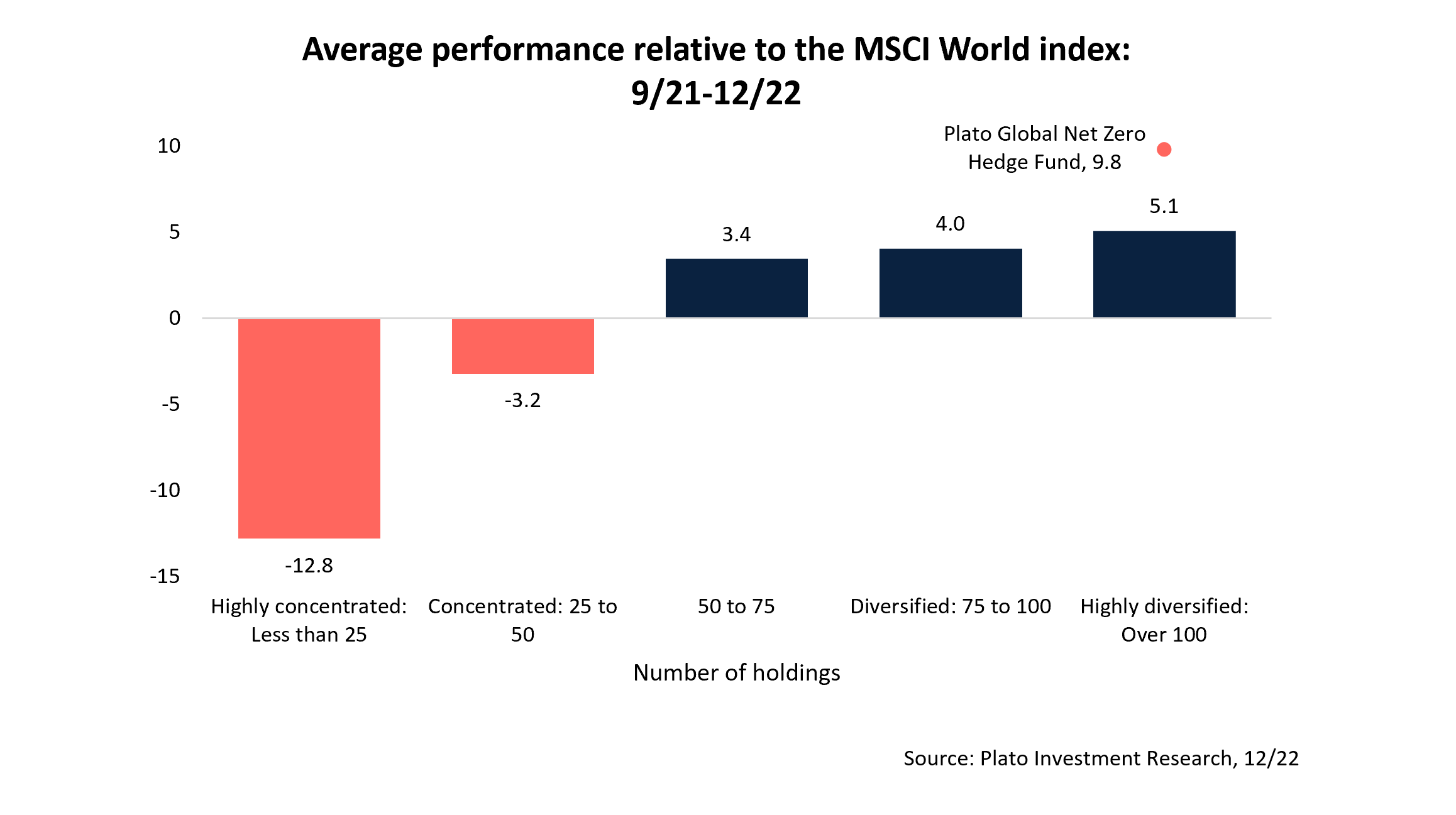

The chart below shows the average performance of global equity funds vs. the MSCI World by number of holdings since September 2021, the inception date of the Plato Global Net Zero Hedge Fund. For this analysis we took every global equity fund in the Morningstar database.

The results are striking. The most concentrated portfolios, holding less than 25 stocks imploded, underperforming by an average of 12.8%. Portfolios with 25 to 50 holdings also underperformed. These averages obscure some rather frightening underperformance from individual funds, with several underperforming by 30, 40 and 50%.

Past performance is not a reliable indicator of future performance.

Meanwhile, you can see portfolios with more than 100 holdings outperformed by more than 5%.

How is it possible for well diversified portfolios like these to outperform so strongly? The global developed market equity universe contains almost 10,000 securities. A portfolio that holds 100 is therefore holding the most attractive 1% of opportunities and is a bona fide best ideas portfolio.

The Plato Global Net Zero Hedge Fund also has over 100 holdings and we have generated higher returns – outperforming the MSCI World index by almost 10% since inception.

Yes, Buffett has long rallied against the evils of “diworsification” – arguing that one should instead put all their eggs in one basket and watch that basket. However, this model has come crashing back to earth with many marquee managers underwater versus their benchmarks not only in 2022, but since inception.

The longer-term evidence

You could argue the above chart doesn’t provide a conclusive illustration of the performance of high concentration, covering a period which was predominately a bear market.

An analysis of the longer-term performance of concentrated managers versus diversified managers was also conducted by Morningstar.

Morningstar Research Services looked at the concentrated portfolios argument using a large sample of US mutual funds between January 1994 and December 2018.1

They concluded there was no statistical difference between the performance of the most concentrated and the most diversified funds. However, they did find that the more concentrated funds tend to have higher fees and more unpredictable returns.

“There isn’t a significant relationship between portfolio concentration and gross returns among U.S. equity mutual funds. Yet, concentrated managers tend to charge more, and the risk of manager selection is greater for these funds because of the wider range of potential returns between winners and losers.”

Active share: A superior proxy for conviction?

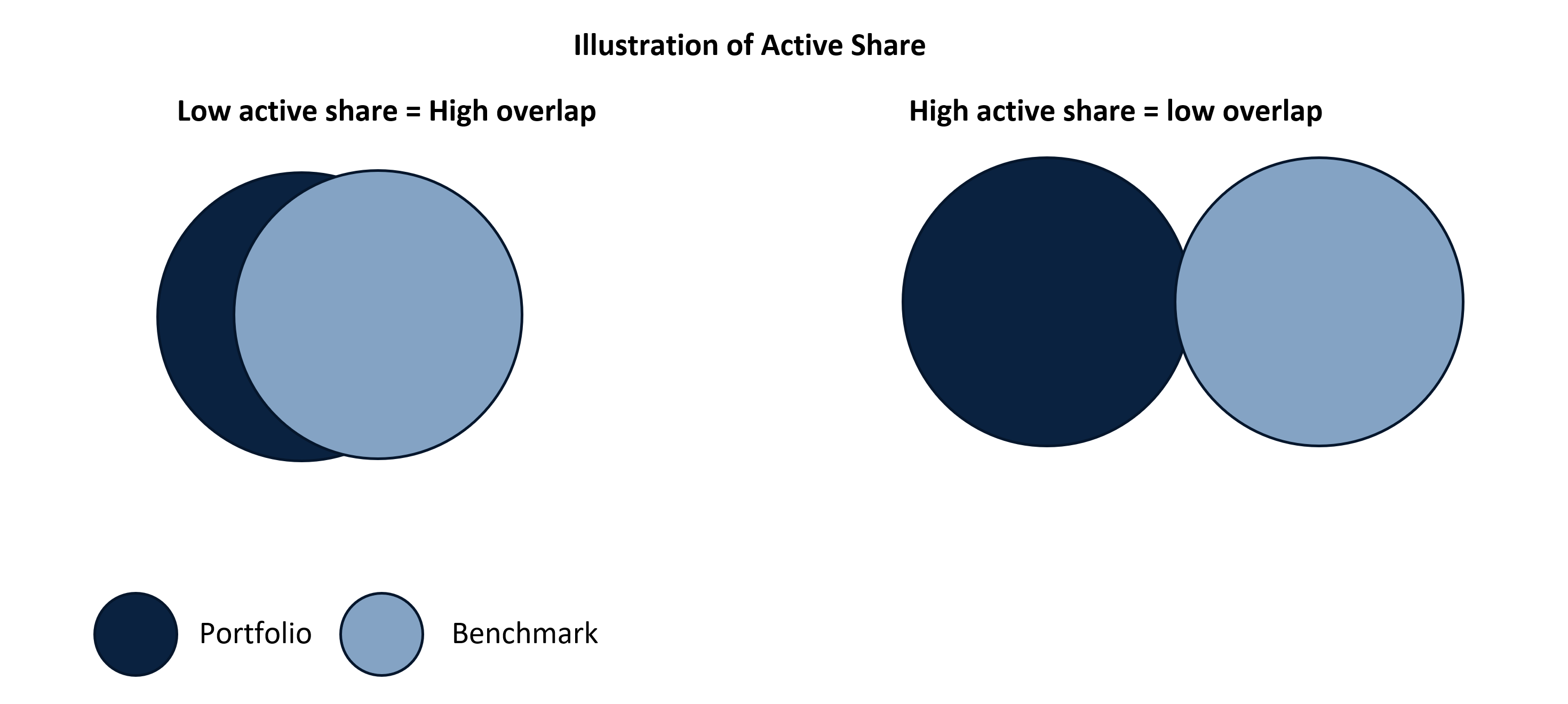

Active share measures the differences between a portfolio’s holdings and its benchmark.

In the below diagram, the dark blue area is the overlap between the holdings of a portfolio and its benchmark. The light blue area represents the non-overlapping holdings and is referred to as the active share. An index fund2 will have an active share of 0%, and an equity fund with no holdings in common with the benchmark will have an active share of 100%.

A portfolio that capitalisation weights the thirty largest holdings in the ASX 300 is not what most people would describe as high conviction.

The active share metric correctly diagnoses this with an active share of just 30%. Perhaps unsurprisingly, funds with the highest active share tend to outperform the market, whereas highly concentred funds do not.3

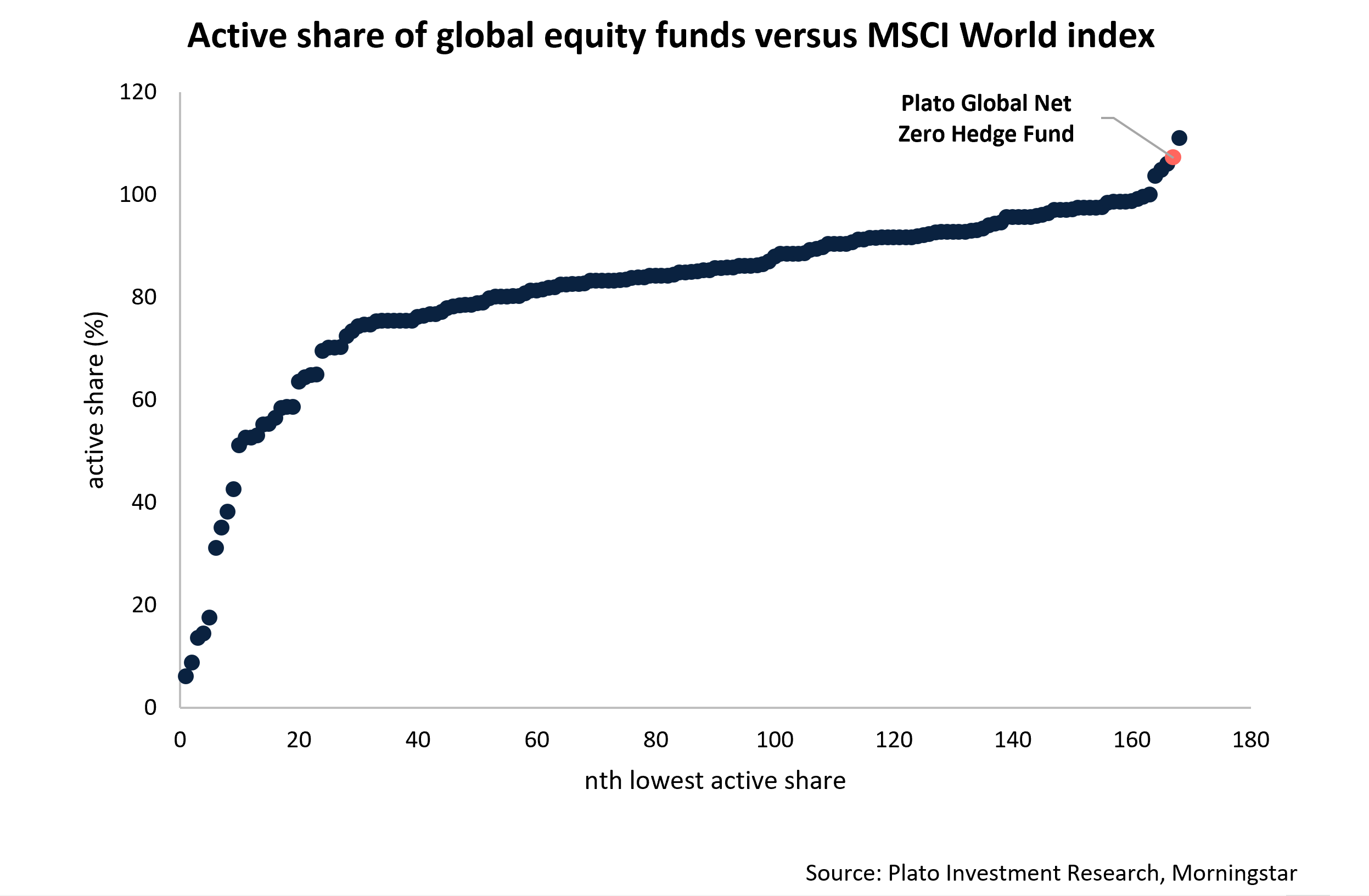

The active shares of all global equity funds in the Morningstar database are shown below, ranked low to high.

Past performance is not a reliable indicator of future performance.

The Plato Global Net Zero Hedge Fund is a case in point. Since launch, the fund has outperformed the MSCI World index by 9.8% after fees, despite having a higher number of holdings than a typical concentrated fund.

The active share exceeds 100% (106%) which is possible because the portfolio is invested 150% long and 50% short.

The extra 50% on the long side relative to a traditional long-only fund gives 50% more exposure to our most attractive ideas, while the 50% short exposure allows the fund to profit by identifying underperformers.

Since launch, the majority of Plato Global Net Zero Hedge Fund’s excess returns have been generated from the short side. The larger number of holdings leads to a smoother, more predictable return stream and less stock specific drawdowns, for example when a certain electric vehicle CEO decides to become the CEO of Twitter.

A final word

The key takeaway from all of this is the data shows like most things in life, there is more than one route to success. Star managers and ‘best ideas portfolios’, might work in some cases, but to generate strong investment returns through-cycle, investors should remain open-minded and question if the data behind conventional wisdom really does stack up.

About the Author

Dr David Allen is head of Short/Long Strategies at Plato, managing the Plato Global Net Zero Hedge Fund. He holds a PhD from Cambridge and Bachelor of Business with First Class Honours.

DISCLAIMER:

This communication is prepared by Plato Investment Management Limited (‘Plato’) (ABN 77 120 730 136, AFSL 504616) as the investment manager of the Plato Global Net Zero Hedge Fund (ARSN 654 914 048) (‘the Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund are available via the links below. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Link to the Product Disclosure Statement

Link to the Target Market Determination

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Plato, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Plato, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Plato. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

“A good decision is based on knowledge and not on numbers.”

Plato (427-347 BC)