This article was published by Livewire on 17 January 2023

While many investors ignore the income potential in global equities, actively managed global equities portfolios continue to be a pillar of strength for income-seeking investors, importantly, providing diversification away from the traditional Australian income stocks and helping to mitigate concentration risk.

After 2020’s pandemic-driven income cuts, global investors have seen strong growth in dividends across 2021 (+12.8% in AUD), and again in 2022 (+15.8% in AUD).

We again expect dividends from global equities to increase in 2023, however, that strong growth trend following the post-COVID period when there was a sharp recovery, will moderate as interest rate rises bite.

How 2022 ended for global dividends

In the final quarter of 2022, we continued to see some large companies, for example, Microsoft Corp, Johnson & Johnson, and Proctor & Gamble, increase their dollar payouts versus Q4 2021. In addition, businesses like Volkswagen AG have recently paid out further special dividends.

Across sectors, we’re also seeing some standouts for dividends. The big recent increases have been from energy companies, with the sector considerably outperforming all other sectors in 2022.

Strong balance sheets, driven by the commodity rally, enabled increased payouts from businesses including Shell, BP plc and Exxon Mobil Corp.

We think this strength can continue into 2023 with energy prices likely to remain elevated.

Global developed markets paid out $A419 billion during Q4. Plato notes income growth was positive in AUD terms, (+6.2% v Q4 2021), although this was largely driven by currency movements, another potential benefit of global diversification.

Dividend growth in local currency terms did slow in the quarter (+0.4% v Q42021), reflecting global inflation and concerns regarding economic growth in 2023. While the small number of companies cutting to zero in Q4 (6.9%) remains at pre-pandemic levels.

This supports our house view of future dividend strength.

A closer look at the year ahead

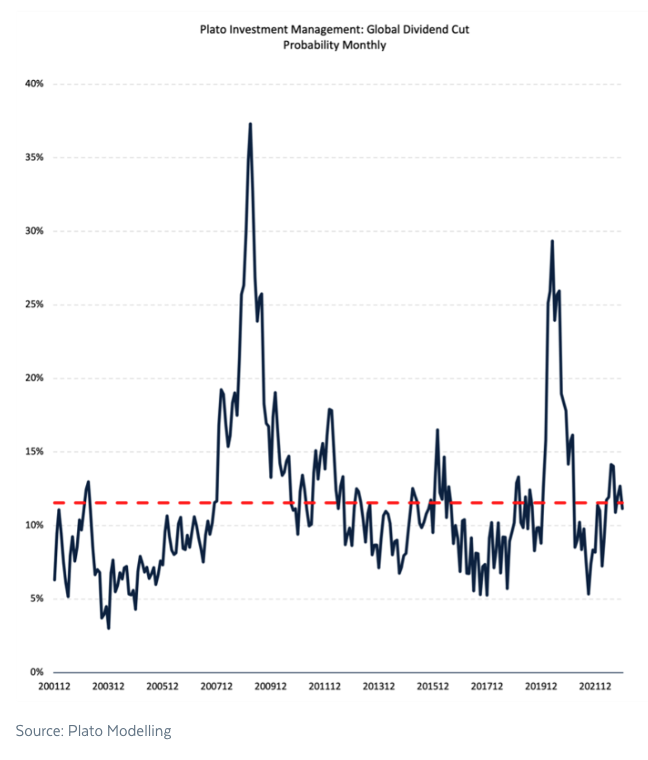

Plato Investment Management’s propriety Dividend Cut Model is showing an 11.2% chance of dividend cuts in global developed markets in 2023, which is below the long-term average.

This benign risk of widespread dividend cuts in global developed markets, gives us great confidence in the year ahead for global dividends and continues to indicate a positive outlook for income.

Although not significantly elevated, Real Estate and Retail are the highest risk industry groups.

Importantly, in the current messy global macro environment, investors must be selective when it comes to dividends, and pay attention to the risk of dividend traps.

One global sector we’re watching very closely for potential dividend traps is Consumer Discretionary, where yields strengthened further over the past year driven by surprisingly strong household balance sheets.

As we look to 2023, it will be interesting to see how the sector goes, given it historically struggles when we see the cost of living pressures and weakening consumer sentiment.”

Global shares continue to provide Australian investors with a great source of diversified income.

The continued post-pandemic growth in global dividends is good news for retirees and other income investors. However, amid economic uncertainty active portfolio management remains critical.

SUBSCRIBE TO OUR NEWSLETTER

Subscribe to keep up to date with the latest fund

information and insights.

“A good decision is based on knowledge and not on numbers.”

Plato (427-347 BC)

Disclaimer

Plato Investment Management Limited AFSL 504616 ABN 77 120 730 136 (‘Plato’).

Whilst Plato believes the information contained in this communication is based on reliable information, no warranty is given as to its accuracy and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Plato disclaim all liability to any person relying on the information contained on this website in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information.

Pinnacle Fund Services Limited ABN 29 082 494 362 AFSL 238371 is the product issuer of funds managed by Plato. Any potential investor should consider the relevant Product Disclosure Statement available at https://plato.com.au/retail-funds/ in deciding whether to acquire, or continue to hold units in a fund. The issuer is not licensed to provide financial product advice. Please consult your financial adviser before making a decision. Past performance is not a reliable indicator of future performance.

Disclosure contained on this website is for general information only. Any opinions or forecasts reflect the judgment and assumptions of Plato on the basis of information at the date of publication and may later change without notice. Any projections are estimates only and may not be realised in the future. Information on this website is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained on the website is prohibited without obtaining prior written permission from Plato. Past performance is not a reliable indicator of future performance.