5 OCTOBER 2023

Dr Don Hamson

In investing there are many risks to consider. One that is often overlooked is volatility drag – particularly for investors who chose to allocate to managed funds or ETFs.

Volatility comes part of the parcel for equity market investors. It can’t be avoided.

However, when your investments are producing higher levels of volatility, this can have a significant drag on your compounded portfolio returns over time, hence the name volatility drag.

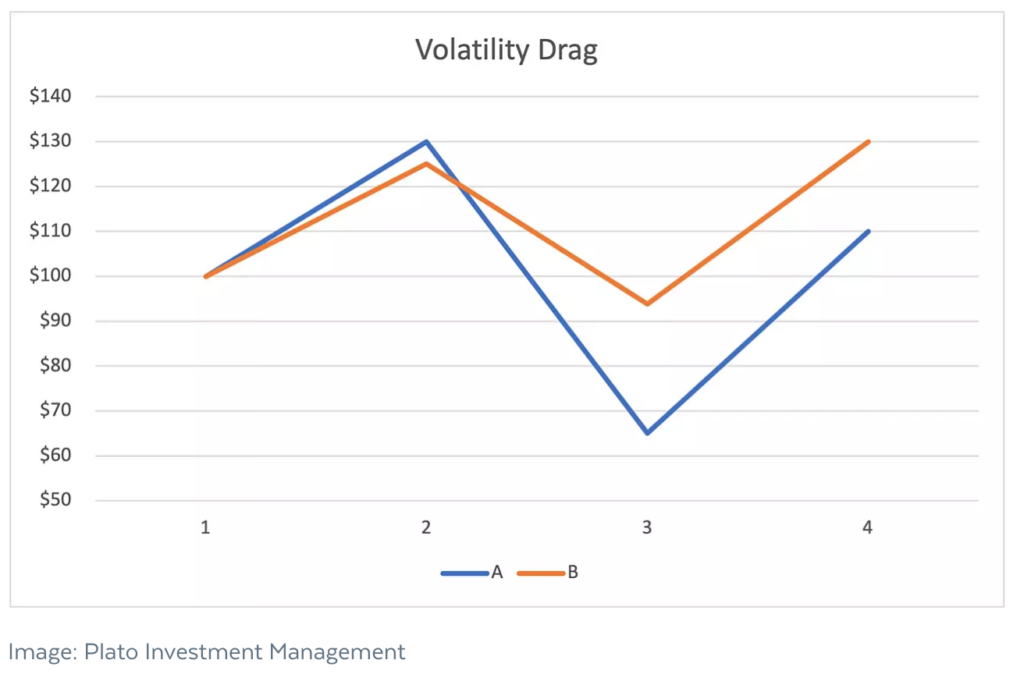

Consider the two investment scenarios below, and their returns over 3 periods:

Investment A:

The portfolio goes up 30%, falls 50% and then rebounds 69%, generating an average return of 16.4% per period.

Investment B:

The portfolio goes up 25%, falls 25% and then rebounds 39%, generating an average return of 12.9% per period.

Which is a better long-term investment?

At first glance it might appear the “higher” returning Investment is a better option.

However, you might be surprised to learn that over the three periods, Investment A earned significantly less than Investment B.

Why is this?

The averages quoted in both investments are simple (or arithmetic) averages.

You just add up the 3 numbers and divide by 3 to get the average. They are not the compounded or geometric average returns.

However, apply the magic of compounding to the scenarios and a stark difference between investment outcomes emerges. This is highlighted in the chart below.

As you can see, $100 invested in Investment A increased to $110 over the 3 periods. This is a compound return of 3.2% per period.

$100 invested in Investment B increased to $130. This equals a compound return of 9.1% per period.

Slow and steady wins the investing race

Another simple way of understanding the impacts of high volatility is to consider this.

If an investment falls 50% (as Investment A did above), it needs to go up 100% to get back to square.

Investment B only fell 25% ,so it only needed to rise 33% to get back to square.

So, it’s clear how volatility can eat into compound returns. If two investments have the same arithmetic returns, but one has higher volatility, the most volatile asset will have a lower return due to the “drag” of higher volatility.

The only free lunch in investing

Volatility drag and diversification are intrinsically linked – diversification reduces risk and hence also reduces volatility drag.

The two investments above were not single stocks, rather, they were portfolios of stocks. Investment A was a poorly diversified portfolio of approximately 20 stocks, whilst portfolio B was a well-diversified portfolio of around 100 stocks.

At Plato, across our equity income and global long/short strategies we build well diversified portfolios of stocks for our clients, because diversification is the only free lunch when it comes to investing.

About the Author

Dr Don Hamson has over 25 years investment management experience and founded Plato Investment Management Limited in 2006. Don has a PhD in Finance and a Bachelor of Commerce with First Class Honours from UQ, and a University Medal.

DISCLAIMER:

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Plato, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Plato, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Plato. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

“A good decision is based on knowledge and not on numbers.”

Plato (427-347 BC)