22 MARCH 2023

Dr. David Allen

The aftershocks of the Silicon Valley Bank debacle are still reverberating around the financial world. Should the venture capital firms that held their deposits with SVB and the regulators have known better? Using Plato’s proprietary 100+ Red Flags the resounding answer is yes.

Further to this, over the weekend UBS were forced into a shotgun wedding with their fiercest rival, Credit Suisse.

Again, Plato’s Red Flags indicate all the warning signs were there for all to see. Unfortunately, the discipline of digging through balance sheets and applying forensic accounting methods seems to have fallen by the wayside in the era of easy money.

Below, I highlight the red flags identified by Plato’s proprietary red flags modelling, for each of these publicly listed company. This modelling meant both SVB or Credit Suisse were screened out early in the Plato Global Alpha Fund’s investment process.

Read more about Plato’s Red Flags modelling here.

Silicon Valley Bank

Red Flag 1: Very high CHS bankruptcy probability

CFAs will remember Altman’s bankruptcy prediction model from 1968. In 2008, three Harvard, academics, Campbell, Hilscher, and Szilagy developed a more accurate model by incorporating market and financial data. Prior to the implosion, SVB’s bankruptcy probability was at extreme levels.

Red Flag 2: Significant vote against executive remuneration

Red Flag 3: Negative votes against directors

Red Flag 4: MSCI flagged concerns over the safety of SVB’s financial products

Red Flag 5: Very high downside volatility

Red Flag 6: SVB had cancelled their dividend

Red Flag 7: Miniscule savings deposits to total deposits

Just 0.9% of SVB’s deposits were savings deposits due to its corporate client base. The tightknit tech community acted almost in unison in withdrawing their deposits. Out of the 458 banks that we track globally, SVB had the 8thlowest percentage of savings deposits. SVB also had the 18th highest percentage of demand deposits making it particularly vulnerable to a bank run.

Red Flag 8: Very high unrecognised losses

Because SVB were intending to hold their long term treasuries to maturity, they did not have to mark them to market. All that changed when they were forced to liquidate their positions to meet deposit withdrawals. Fortunately, this was apparent in the FY22 financials with accumulated other comprehensive income accounting for some 11% of total equity.

Red Flag 9: Very high proportion of uninsured depositors

This is a Red Flag that we did not have as part of the Plato process that we are now looking to add. Some 93.8% of SVB’s deposits were over the $250,000 threshold and hence uninsured and prone to flight.

Credit Suisse

In Plato’s 10,000 stock investment universe, most companies have 0 or 1 red flags. So for a company to have over 9 red flags as with SVB really attracts our attention. Credit Suisse, had a frightening 16 red flags. Interestingly, there is a lot of overlap with the warning signs we saw for SVB. Because these flags are proprietary we do not list all of them here, so here is a subset.

Red Flag 1: Internal control weakness flagged by auditors

Red Flag 2: Very high CHS bankruptcy probability

Red Flag 3: Significant vote against executive remuneration

Red Flag 4: Financing difficulties

Red Flag 5: High impact governance events

Red Flag 6: Very poor audit quality score

Red Flag 7: Zero sell-side buy ratings

Sell side analysts are loath to place sell ratings on a company’s stock for obvious reasons. The fact there were zero buy ratings on Credit Suisse speaks volumes.

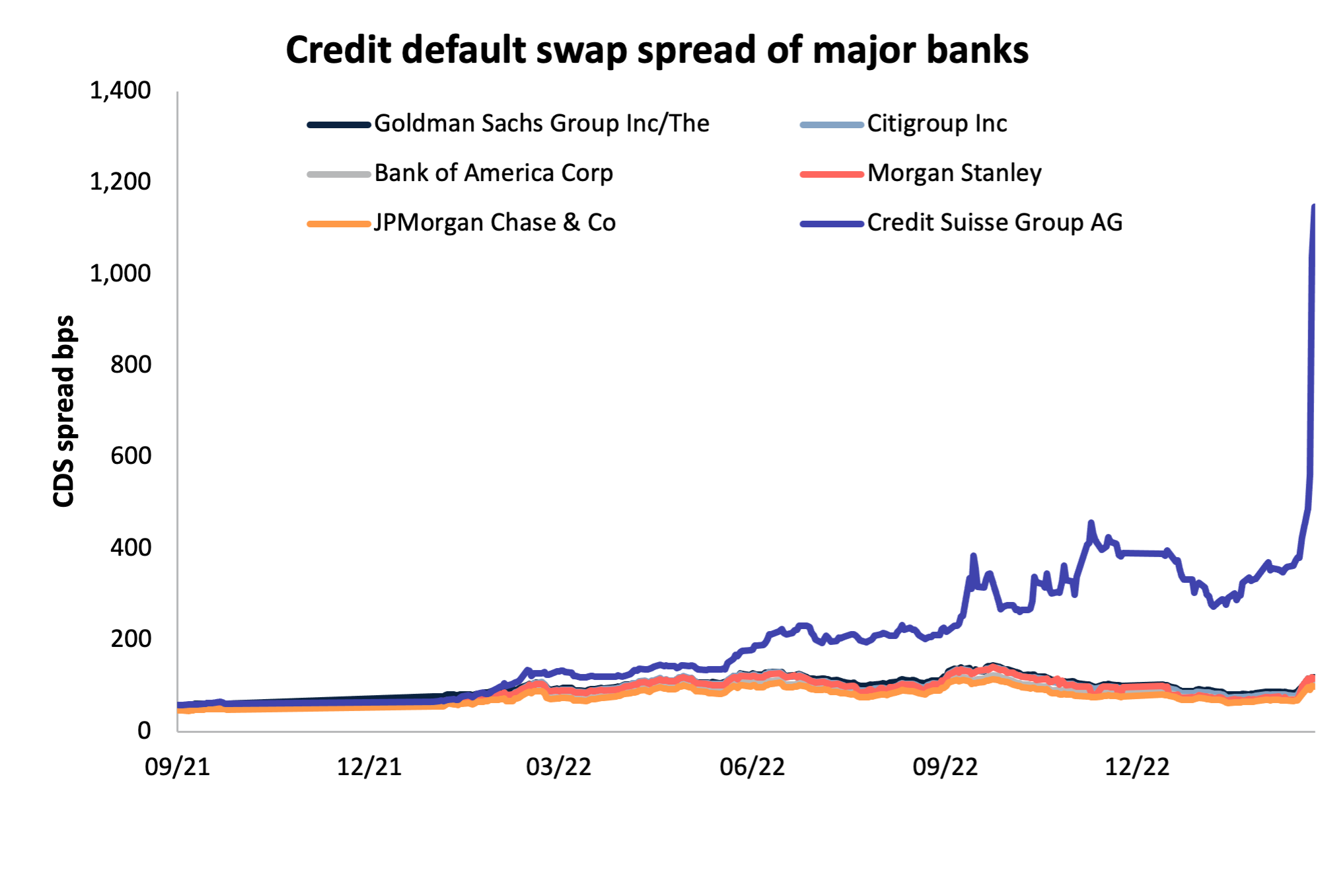

Red Flag 8: Credit default swap spikes

The CDS spread is the cost of insuring against default. For a long time, the CDS spread of Credit Suisse was similar to that of the major global banks, that is until June, 2022.

About the Author

Dr David Allen is head of Long/Short Strategies at Plato. He holds a PhD from Cambridge and Bachelor of Business with First Class Honours.

DISCLAIMER:

This communication is prepared by Plato Investment Management Limited (‘Plato’) (ABN 77 120 730 136, AFSL 504616) as the investment manager of the Plato Global Net Zero Hedge Fund (ARSN 654 914 048) (‘the Fund’). Pinnacle Fund Services Limited (‘PFSL’) (ABN 29 082 494 362, AFSL 238371) is the product issuer of the Fund. PFSL is not licensed to provide financial product advice. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited (‘Pinnacle’) (ABN 22 100 325 184). The Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) of the Fund are available via the links below. Any potential investor should consider the PDS and TMD before deciding whether to acquire, or continue to hold units in, the Fund.

Link to the Product Disclosure Statement

Link to the Target Market Determination

For historic TMD’s please contact Pinnacle client service Phone 1300 010 311 or Email service@pinnacleinvestment.com

This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance.

Whilst Plato, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Plato, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication.

Any opinions and forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Plato. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication.

“A good decision is based on knowledge and not on numbers.”

Plato (427-347 BC)