We didn’t get another “historic” rate cut from the RBA on February 2, but we did get some absolute confirmation of what we’ve been saying for quite some time – rates are staying lower for longer.

In his rate decision statement, Philip Lowe said, “The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest.”

In short, Lowe’s probably not going to even think about lifting the cash rate until at least 2024. The ramification of this statement for those investors still trying to make ends meet from yield on term deposits and other cash-backed products is obvious.

But that’s where the retirement income pessimism should stop – after a tough year for dividend income, there’s a break in the clouds.

We’ve entered 2021 with some positive news, which lays a strong foundation for what should result in a strong dividend recovery in the coming 12 months.

Bank dividends

The first piece of positive news, a capital management update from APRA in December. The regulatory authority repealed restrictions imposed on banks earlier in the year regarding dividend payout ratios. In April 2020, APRA initially warned against paying any level of dividend. In July, an update putting dividends bank on the table, but the authority said they must not exceed more than 50% of earnings.

But the December update put an end to the regulatory uncertainty with APRA noting further improvement in the economy and removing all hard restrictions on bank and insurance dividends.

Bank dividends cut an average of 60% in FY2020 so there is significant upside. While we don’t expect them to go back to pre-COVID-19 levels for at least another two years, we do expect to see bank dividends begin to move toward more normal payout ratios of between 70 and 80 per cent over the next 12 months. Still a big improvement from what many were anticipating only a few months ago.

Franking is here to stay

The second announcement was from Federal Labor Leader Anthony Albanese. Many readers of this article will remember myself and the Plato team campaigning against Labor’s policy to scrap franking credits at the last Federal Election. This would have had a serious impact on retirement income. In fact, the policy was labelled the ‘retiree tax’ by many.

On January 2, 2020, Mr Albanese said in an online address to Labor party members, “I can confirm that Labor has heard that message clearly and that we will not be taking any changes to franking credits to the next election.”

Uncertainty surrounding franking credits has been an ongoing concern for retirees seeking to move into equities to generate income. It’s been a common theme during my firm’s regular investor Q&A’s.

If you take Fortescue Metals (FMG) for example you can see why. For tax-exempt investors, the Iron Ore miner paid a gross yield including franking of 14.5% in 2020 – that’s more than 4% from franking alone.

Dividend cut probability reduced

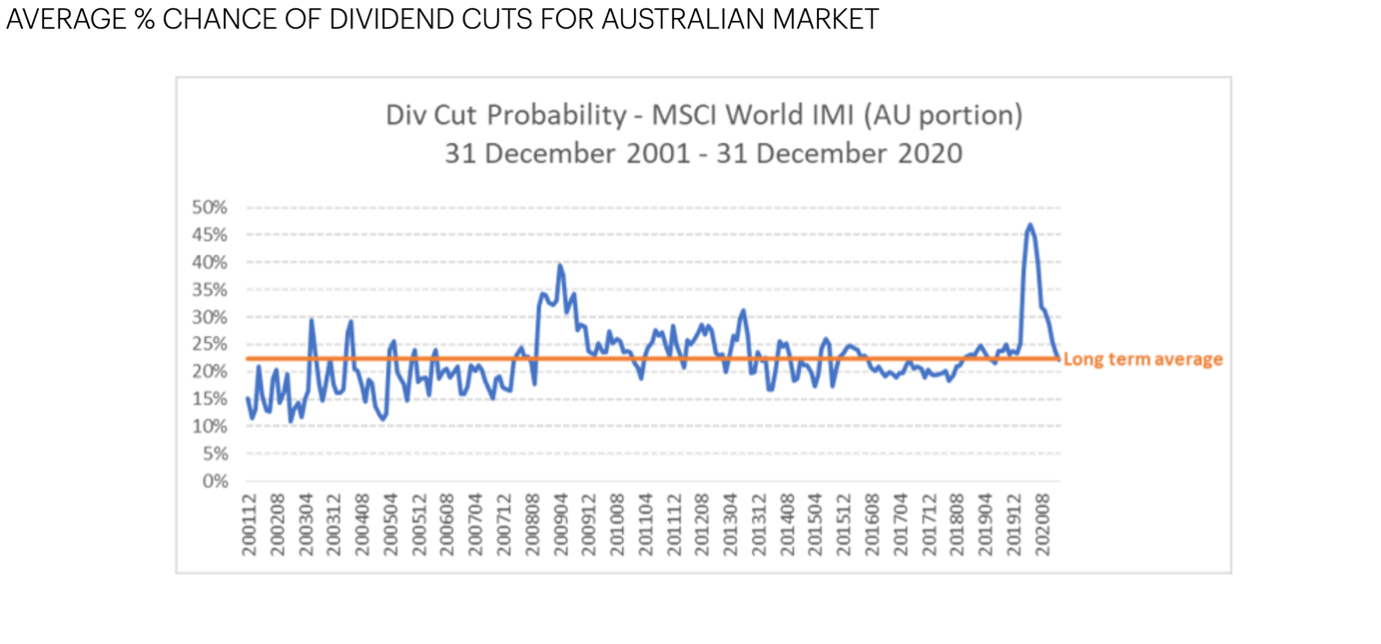

For more than a decade, the Plato Investment Management team has been using proprietary quantitative analysis to predict the likelihood of dividend cuts. Our latest modelling now shows a significant improvement in the outlook, with the probability of dividend cuts from Australian stocks now back to around the long-term average. To us this signals that the big COVID-19 related dividend cuts are now behind us.

The income landscape

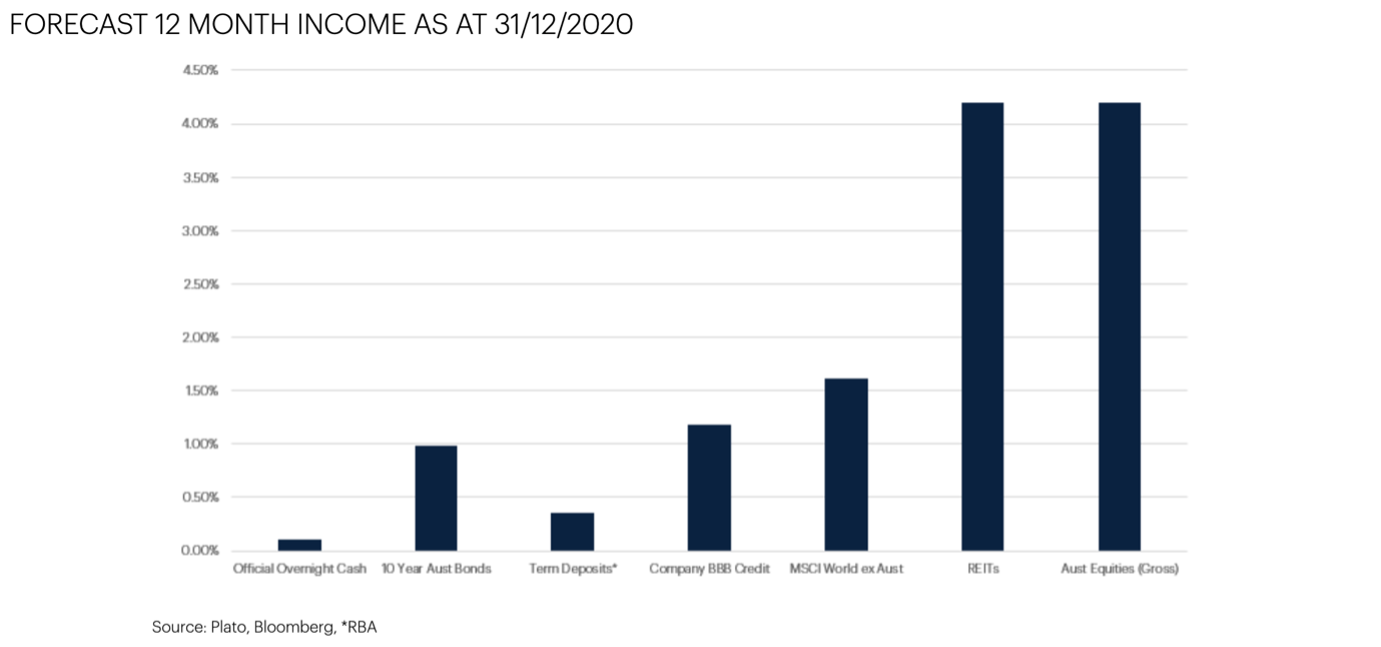

Buoyed by some of the aforementioned factors, we maintain an actively managed and well diversified portfolio of dividend paying stocks is the most compelling income generating strategy, particular for Australian retirees.

Our latest 12-month income forecast shows equity income remains well above other major asset classes.

Whilst the big traditional Australian income stocks such as the banks have cut dividends and underperformed, on the upside, we’ve been generating strong income for investors from miners such as Fortescue Metals, BHP and Rio Tinto in recent years and we expect this to remain consistent throughout the year.

We also expect strong yield from select retail businesses in the year ahead – the likes of Wesfarmers, Coles, Super Retail and JB Hi-Fi.

When it comes to the banks, the Commonwealth Bank maintains a strong balance sheet with excess capital. This raises the likelihood of a buyback in the coming years, which would benefit retirees particularly.

On the flip side, avoiding dividend traps is still important, although it would appear there are now less dividend traps in the market than there was in 2020. We would caution inflated historical yield figures in sectors such as Tourism and Leisure, Energy and Infrastructure and Retail REITs.

Finally, the only free lunch remains diversification. And for retirees, that lunch can get a little better if your portfolio is being managed to take advantage of franking credits and other tax-effective opportunities such as buybacks.