While there are a range of different options for income-seeking investors, the Plato team believes the long-term benefits of dividend income investing can provide a superior solution, particularly for pension-phase investors who rely on income from their capital to make ends meet.

To demonstrate the benefits of dividend income, I often use a personal case study – the financial history of my parents’ retirement.

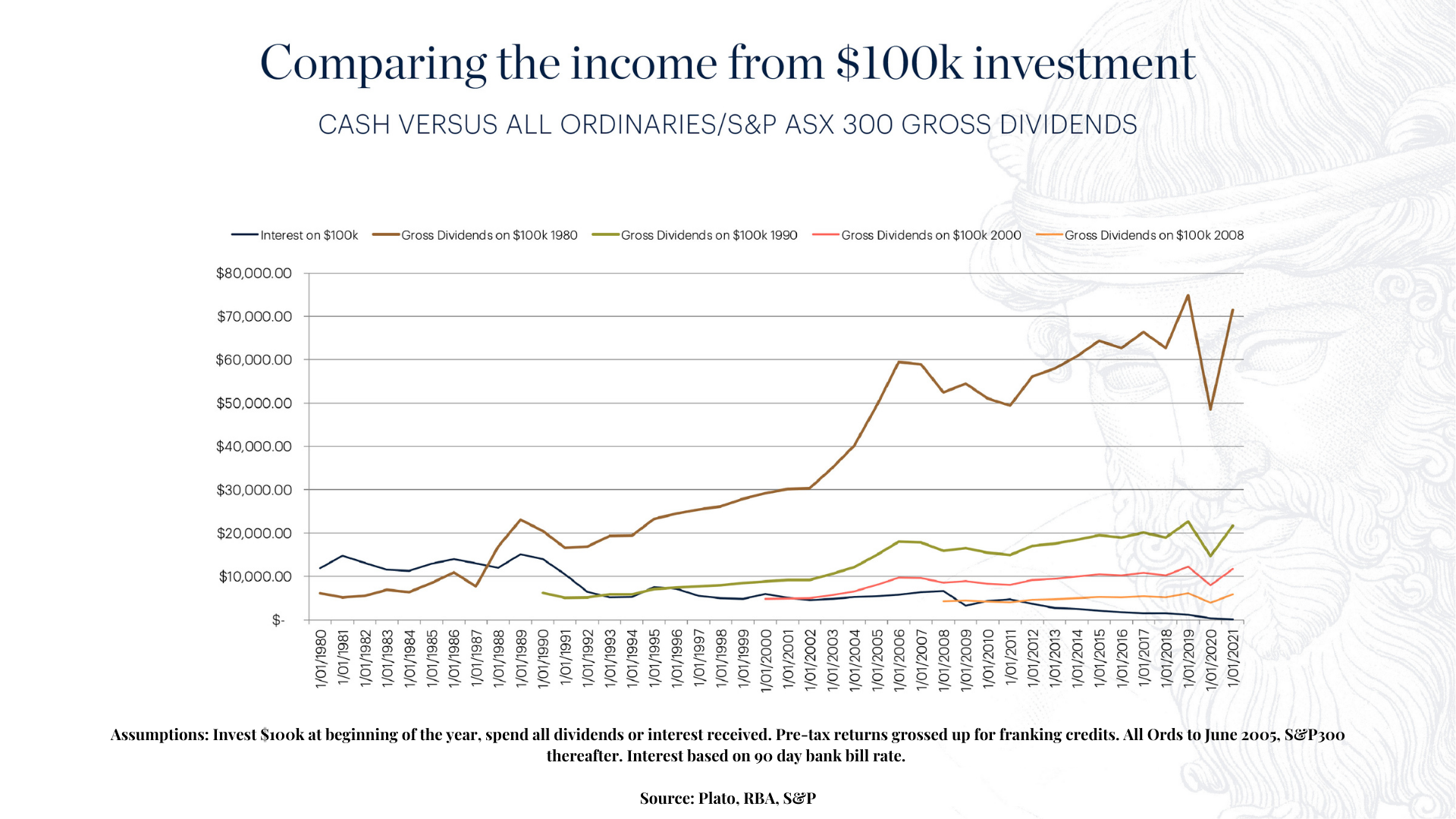

They retired in 1980 and the chart below highlights the amount of income they could have received from the two main asset classes available – cash in the bank, or dividends.

The chart shows $100,000 invested at the start of 1980 and the resulting return if you had:

- Put $100,000 in the bank and calculated the amount of interest received each year.

- Put $100,000 into the All Ordinaries index , and subsequently S&P 300, and tracked the amount of income received from dividends and franking credits.

You can see that in the 80s interest rates were very high and in the first six or seven years my parents got more bank interest than they did dividends. However, once franking came in during the late 80s you actually got more dividend income from shares.

Now, because my parents were retired, they lived off that dividend income, so the chart factors in the fact that none of those dividends were reinvested. Normally when you see an accumulated chart of this nature it accumulates to a very high amount. But if you’re retired, you’re living off that income so the chart demonstrates what would have occurred in the case of a retiree who uses their income to pay bills and take holidays.

Had my parents invested in cash in 1980, in the 90s they would have hit a stage where they simply would not have been able to make ends meet from interest income. In fact, up until very recently, interest income fell for three decades.

On the other hand, you can see income generated from a portfolio of Australian shares is now approximately $70,000. Sure, there are some ups and downs. Dividends did fall in the recession we had to have in the early 90s, dividends fell during the GFC, and again in the pandemic year, but they have continued to grow outside of that period.

This is one reason to consider dividend income – equities tend to grow over time, profits grow and dividends grow. Even without reinvesting any money, you can get an increasing dividend stream over time.

So, you can see my parents were much better off having invested in the share market than living off the interest from a bank account with the same initial investment.

Of course there are risks to consider and we believe active and tax-effective portfolio management is key, but like my parents, dividend income can be a great solution for retirees today.

Read next: What are Franking Credits?

Discover more about investing in the Plato Australian Shares Income Fund here.

SUBSCRIBE TO OUR NEWSLETTER FOR MORE INCOME INVESTING INSIGHTS

SUBSCRIBEDISCLAIMER:

This document is prepared by Plato Investment Management Limited ABN 77 120 730 136, AFSL 504616 (‘Plato’). Pinnacle Funds Services Limited ABN 29 082 494 362, AFSL 238371 (‘PFSL’) is the product issuer of the Plato Australian Shares Income Fund (‘the Fund’). The Product Disclosure Statement (‘PDS’) of the Fund is available at https://plato.com.au/. Any potential investor should consider the relevant PDS before deciding whether to acquire, or continue to hold units in, a fund.

Plato and PFSL believe the information contained in this document is reliable, however no warranty is given as to its accuracy and persons relying on this information do so at their own risk. This communication is for general information only and was prepared for multiple distribution and does not take account of the specific investment objectives of individual recipients and it may not be appropriate in all circumstances. Persons relying on this information should do so in light of their specific investment objectives and financial situations. Any person considering action on the basis of this communication must seek individual advice relevant to their particular circumstances and investment objectives. Subject to any liability which cannot be excluded under the relevant laws, Plato and PFSL disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information.

Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. Past performance is not a reliable indicator of future performance.

Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this document is prohibited without obtaining prior written permission from Plato. Plato and their associates may have interests in financial products mentioned in the presentation.